Mattress manufacturer is committed to the promotional mattress segment and the consumers who shop it

Michael Thompson and his team at Corsicana Mattress Co. are on a mission. Their quest? Providing hard-working Americans with innovative and affordable sleep products that improve their quality of life.

To accomplish this ambitious goal, Thompson has been studying closely and refining every aspect of the company’s operations since taking his post as chief executive officer of the Dallas-based company in the summer of 2018. The former president and CEO of Sleep Innovations (now part of Innocor Inc.), Thompson joined Corsicana with a strong background in consumer packaged goods, having held executive posts at Flexi-Mat, Newell Rubbermaid, Black & Decker and Sunbeam. Prior to joining Corsicana, Thompson also served as operating partner for The Riverside Co., a global private equity firm.

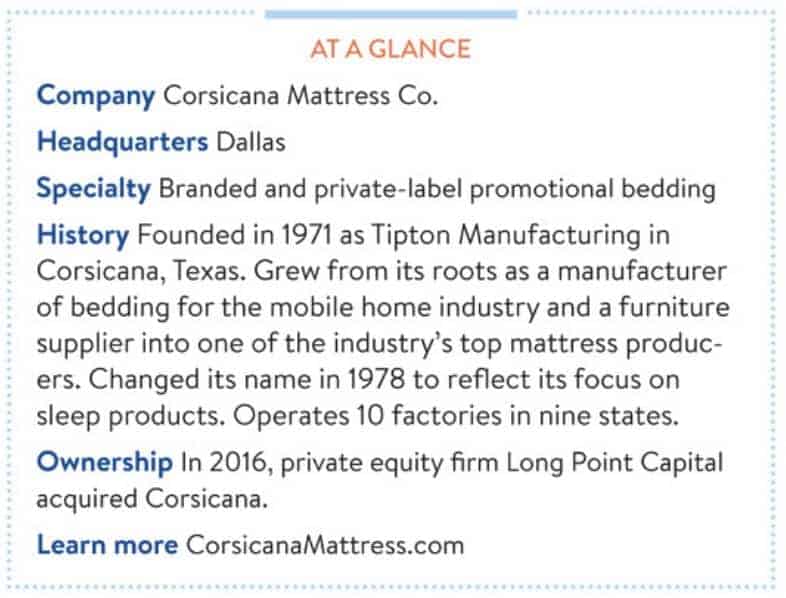

When Thompson took the helm of Corsicana, “the company had reached an inflection point and sales growth had stalled,” he says. Founded in 1971 in Corsicana, Texas, by Harold Moran and his wife, Gail, Corsicana had grown into one of the industry’s leading producers of promotionally priced bedding under the leadership of their son, Carroll Moran. In 2014, the Moran family sold a majority interest in the company to private equity firm Fenway Partners, which in turn sold the business in 2016 to current owner Long Point Capital, another private equity firm.

“Corsicana has a rich history within the bedding industry,” Thompson says. “It’s a great story of American entrepreneurism and a family that built something big from scratch, creating opportunity for so many other families and individuals. But after nearly a half-century of success, some of the products and processes needed to be updated and re-energized.”

Blueprint for change

To reposition Corsicana for growth, Thompson took his first — and perhaps most important — step within the first 72 hours of assuming his new job. That’s when he initiated a comprehensive market segmentation study to better understand the types of consumers who are in the market for Corsicana bedding, the key mattress features they seek, and where they go to shop and purchase.

Designed with the help of an outside consultant, Corsicana’s survey identified four major consumer segments for mattresses: Cost-conscious value seekers, e-commerce connoisseurs, healthy sleep fanatics and ultimate comfort enthusiasts. The emergence of e-commerce connoisseurs is a relatively new development in bedding, so having fresh data on this group makes Corsicana’s market segmentation study a particularly valuable tool, Thompson says. According to the company’s study, e-commerce now accounts for 20% of the total U.S. bedding market.

“The consumer behavior around each of these segments is completely different, and so is the path to purchase,” says Mike Loomis, vice president of product development and innovation, who joined Corsicana in August 2018 after working with Thompson at Innocor and Black & Decker. “Each group has its own specific needs and a unique process in how they shop the category. Looking past the obvious differences in features and benefits desired by each segment, behaviors like how long they keep their mattress, what motivates them to buy a new mattress, how much research they do before buying, where they get their information and where they shop varies dramatically by consumer segment.”

Armed with these insights, Corsicana set out to completely reconfigure its product assortment, merchandising strategies and brand messaging to make sure all its efforts are focused on the four consumer segments. The process started with a review and update of the company’s entire product lineup.

“We have a large number of independent retailers who all wanted their own private label,” Loomis says. “We’d do our best to accommodate them, but that wasn’t always the best decision for our company. It led to a lot of SKU proliferation and also into some higher-end price points and upscale constructions that weren’t always our strengths.”

The never-say-no approach also created some production inefficiencies when the company’s plants were called upon to make myriad beds in small runs to meet retailers’ needs for exclusive products, Loomis explains. “Adding that level of complexity caused challenges for our plants, including inefficiencies in sourcing and production flow,” he says.

Going forward, private-label products will continue to be a big part of Corsicana’s business. But the program now is focused on larger-volume collections that meet a minimum order threshold. Private-label programs that fall beneath that level will be replaced by the company’s branded model lineup, which was remerchandised for the Las Vegas Market in January.

Making the change was like changing a tire while the car is moving, Thompson says. “It required rethinking everything we do, from product development and pricing to brand messaging and the design of our showroom,” he says.

Most of the hard work is done, he adds, with the company now more efficient, more cost competitive, and better able to anticipate and take advantage of emerging opportunities.

“We have a clear game plan centered around best practices and repeatable methodologies in every aspect of the business — from production to sales and marketing,” Thompson says. “And we’ve instilled a new high-performance culture built on five Es: edge, energy, engagement, execution and enthusiasm.”

Four high-value brands — and counting

Corsicana’s branded mattress lineup now consists of four collections of promotional and step-up products, including innerspring, memory foam and hybrid models. All the company’s products are aimed at the under-$1,000 retail market. Testifying to its position as a high-volume supplier, Corsicana recently shipped its 100 millionth unit since starting in business nearly a half-century ago.

The company’s newly remerchandised line starts with two collections for those cost-conscious value seekers from the market survey. The first is Sleep Inc., retail priced from $199 to $299 for a queen-size set, and available in two profiles. The second is American Bedding, which runs from $299 to $599. Founded in Gainesville, Georgia, in 1939, and acquired by Corsicana in 2012, American Bedding is one of the industry’s oldest brands. The collection is available in five profiles and features pocket spring construction.

“American Bedding offers a range of high-quality mattresses without the premium price tag,” says Eric Jent, executive vice president of sales, who joined Corsicana in 2017 after serving in sales management positions with Ashley Furniture, King Koil and Simmons Bedding. “Like all of our products, American Bedding is made in the U.S. and provides lasting durability and complete comfort.”

Corsicana’s third collection is Renue. Priced from $599 to $799, Renue is designed for the healthy sleep fanatics who want to wake up feeling refreshed and “renued.” The line is available in thicker 12-inch and 14-inch profiles, with premium copper performance foam for advanced cooling and optimal support.

In addition, the company introduced a fourth collection in January called Early Bird. Designed for the e-commerce connoisseurs, Early Bird features five foam and hybrid mattresses that retail from $599 to $799. The new products are roll packed and shipped in a box, similar to other direct-to-consumer bedding brands, but consumers have the choice of picking up products in-store or having them delivered by a local retailer.

An additional consumer segment that Corsicana has identified as core to its business — the ultimate comfort enthusiasts — will be addressed more fully at the Las Vegas Market in July. “These will be step-up products in the $799 to $999 range with enhanced materials, construction and features,” Loomis says. “Comfort will be the driving factor in all these models.”

Low-cost mindset

For the first time in 10 years, Corsicana opted not to show at the High Point Market in April. Management made the change as part of its strategy to keep costs low, Thompson says. “We want to make every dollar count, and we just didn’t see a need to be in two market locations. It’s part of our unwavering promise to deliver outstanding sleep at an unbeatable value.”

To highlight its new mindset and expanded product line, Corsicana debuted a remodeled Vegas showroom in January. During the show, the 7,800-square-foot space featured a series of bedroom vignettes showcasing the company’s four brands. Each presentation featured distinctive accents and an aesthetic unique to the product line. Messages displayed on video monitors and creative wall graphics provided additional details about key mattress features.

“We got a lot of great feedback about our upgraded showroom in Las Vegas,” Thompson says. “January was our best market in years, and the buzz was evident from the first day. This showroom is the perfect spot for our retail partners to fully experience what we’re all about.”

Corsicana wants its Vegas showroom to serve as a “catalyst for ideas that will lead to improved business for our dealers in the ultra-competitive promotional and midpriced segments of the marketplace,” Thompson says. “It helps present the value proposition that each of our brands offers and allows us to showcase how each line fits into the target demographic.”

Corsicana, among the nation’s largest bedding producers, serves a diverse base of more than 3,000 retailers coast to coast, including sleep specialists, furniture stores and leading chains. It operates 10 company-owned plants in strategic locations throughout the country.

At one time, Corsicana’s sister company, Sleep Inc., also produced other national brands on its own or under license. The nameplates included Spring Air, which parted ways with Corsicana in August 2018 as part of its shift to working with independent producers with smaller, more defined territories. Sleep Inc.’s activities were folded back into Corsicana about 10 years ago, when Corsicana undertook an aggressive push to acquire more plants and become a nationally distributed producer.

“Our focus now is on our own brands and our major customers’ private-label products,” Thompson says.

Fostering innovation

To promote the creative thinking required to succeed in today’s fast-moving bedding market, Corsicana has established a new Innovation Center at its Dallas headquarters, where staff and customers can meet to work on new ideas for products. The center includes testing equipment and component samples, providing a working lab where new concepts can be explored and refined, Loomis says.

“It’s a great setting for brainstorming around new materials and processes,” he says. “There are a lot of exciting developments in the areas of technology and design, and the Innovation Center will help us figure out what makes the most sense for our line.”

With all its new products, Corsicana will focus on the promotional end of the market, Thompson says. The company won’t add a new technology unless it’s a good fit for its customer base and pricing structure.

“Our primary goal is to produce the best feeling mattress with the best look at the best price. That’s the value proposition our customers expect from us — and that’s what we are committed to delivering,” he says.

The fact that Corsicana’s prices are so low can be a source of confusion for some retailers, according to Thompson. “They see our price points and wonder where the profit margin is,” he says. “The answer is velocity — the fact that our high-value products sell much faster and more frequently than other higher-end product on their floors.”

Mattresses less than $1,000 is where the action is in terms of what consumers are looking for and can afford, and that threshold isn’t going to change any time soon, Thompson believes.

“Average unit selling price has been going up consistently for many years, but if you factor in the shift in mattress sizes — most consumers today buy queens rather than twin- and full-sized models — and inflation, AUSP has actually gone down,” he says. “That means that consumers are getting more for their money than ever before, and that our segment of the market continues to be tremendously important.”

Corsicana looks out for retailers with new dealer portal, boxed line

Recognizing the power the digital realm holds to deliver information and reach consumers, Corsicana Mattress Co. has rolled out two major web-based programs since the beginning of 2019.

The first initiative, the Go Corsicana dealer portal, was unveiled at the Las Vegas Market in January. The new password-protected portal allows Corsicana’s dealers to place and track orders with a few clicks, providing instant updates on product availability and shipment schedules. In addition, it gives the company’s sales representatives the ability to track sales in their territory or a specific metro area, plus share consumer analytics and competitive insights that can be used to help retailers strengthen their floor assortments and fine-tune marketing messages.

The first initiative, the Go Corsicana dealer portal, was unveiled at the Las Vegas Market in January. The new password-protected portal allows Corsicana’s dealers to place and track orders with a few clicks, providing instant updates on product availability and shipment schedules. In addition, it gives the company’s sales representatives the ability to track sales in their territory or a specific metro area, plus share consumer analytics and competitive insights that can be used to help retailers strengthen their floor assortments and fine-tune marketing messages.

“The portal enables our sales team and their customers to operate much more efficiently by putting critical data right at their fingertips,” says Gary Gray, general manager of digital for the Dallas-based mattress producer. “Our sales reps can be much consultative with their dealers, helping them replace slow sellers with models that match up best with the key market segments that they serve.”

Corsicana’s ability to collect, analyze and share data with its retailers will be an increasingly important point of competitive differentiation, says Eric Jent, executive vice president of sales. “We can give them up-to-date analytics on how specific products are performing in their stores or look at sales trends in other markets with similar demographics,” he says. “We can also help retailers identify who is in the market for bedding locally and what they are looking for.”

“We’re going to leverage the power of all this data to help retailers make the most of every opportunity,” Jent adds.

In March, Corsicana rolled out a microsite for its new Early Bird boxed bed line. Introduced at the winter Vegas market, the group features five compressed and roll-packed foam and hybrid mattresses with suggested retail prices from $599 to $799 in queen size. Consumers can order them online or in-store, and the beds are available for in-store pickup, delivery from a local retailer or direct shipment from Corsicana.

“Many of our retail partners said that they needed a stronger competitive brand in their arsenal to compete with the growing number of online-only specialists,” Gray says. “Early Bird is that solution. It is competitively priced, has great design and quality, and is handcrafted in America.”

Colorful and engaging, the Early Bird website is designed to help drive consumers to Corsicana’s retailers across the country. Consumers can access the site through CorsicanaMattress.com or through links on dealers’ domains.

“E-commerce connoisseurs have a different path to purchase than the typical consumer,” Gray says. “This market segment likes to do their research online by visiting websites and reading product reviews. They gather the information they need to make a decision about which product is right for them, and then they identify the best place to buy it.”

When shopping for many home furnishings, consumers will place their orders online without ever entering a store. However, because mattresses are “such a tactile product, many consumers prefer to test the bed before buying if they can,” Gray says, adding that the Early Bird program offers a bridge between the digital and physical worlds. “Consumers can do their initial research online and visit their local store to make sure the bed they’ve chosen feels right before it is delivered.”

Corsicana plans to promote the Early Bird line through an active social media program, as well as creative pop-up events held with retail partners in major markets.